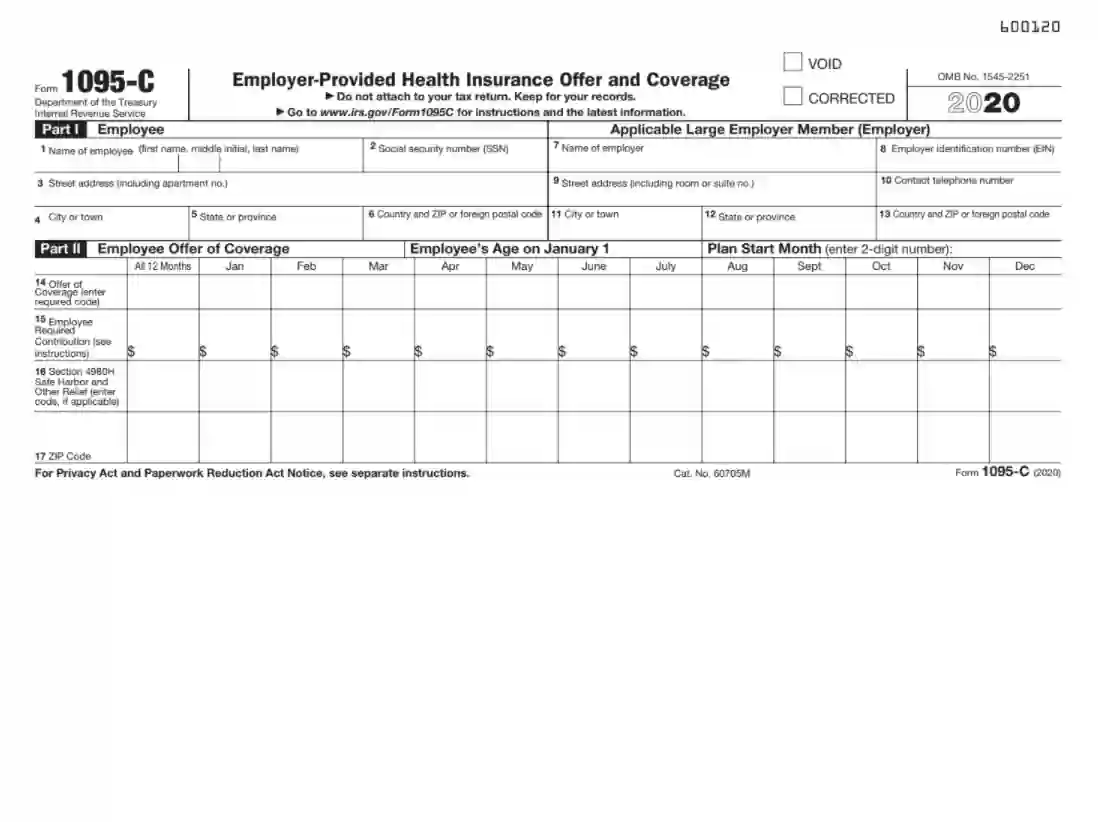

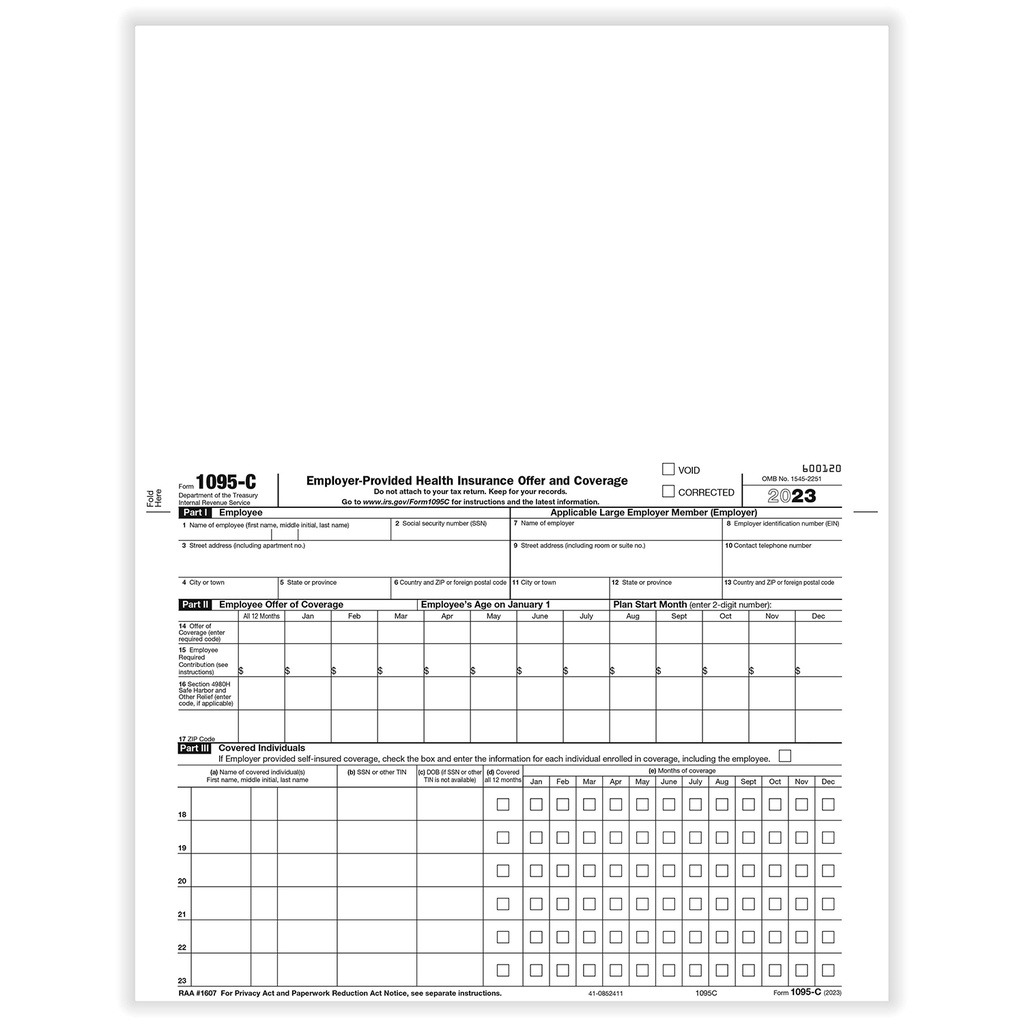

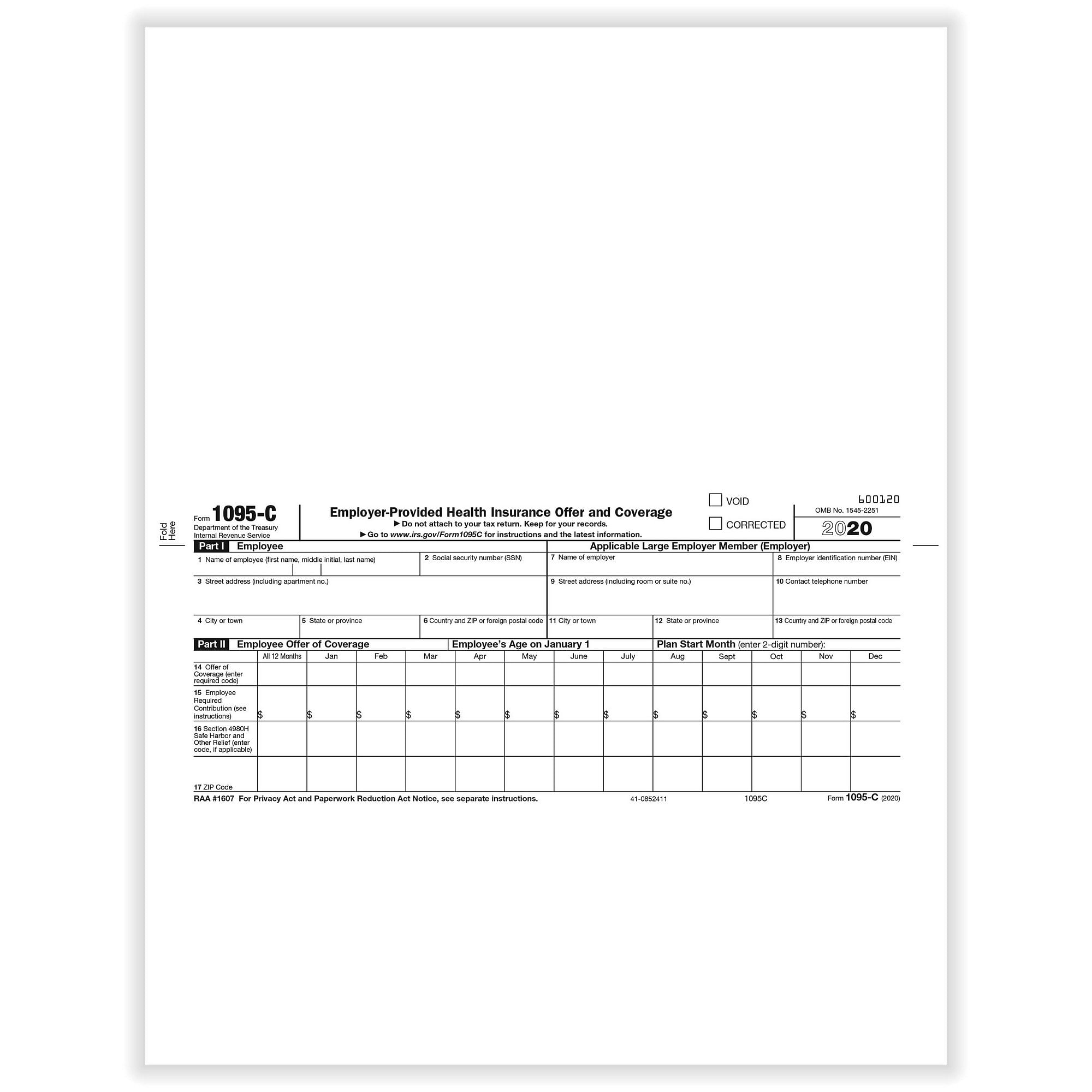

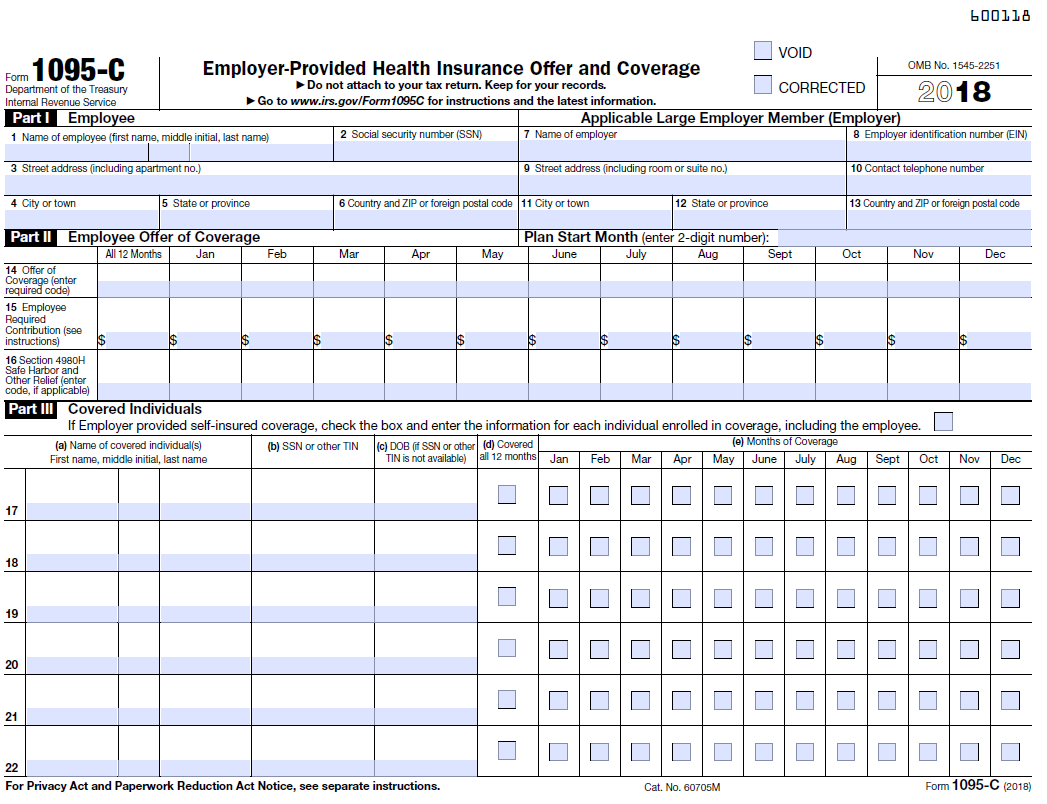

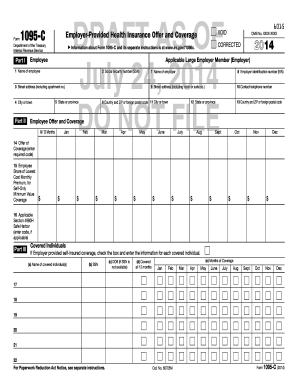

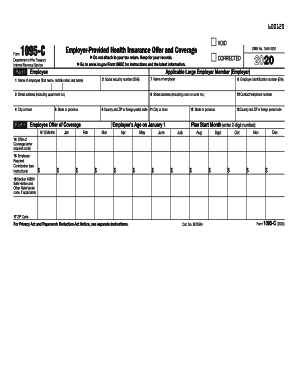

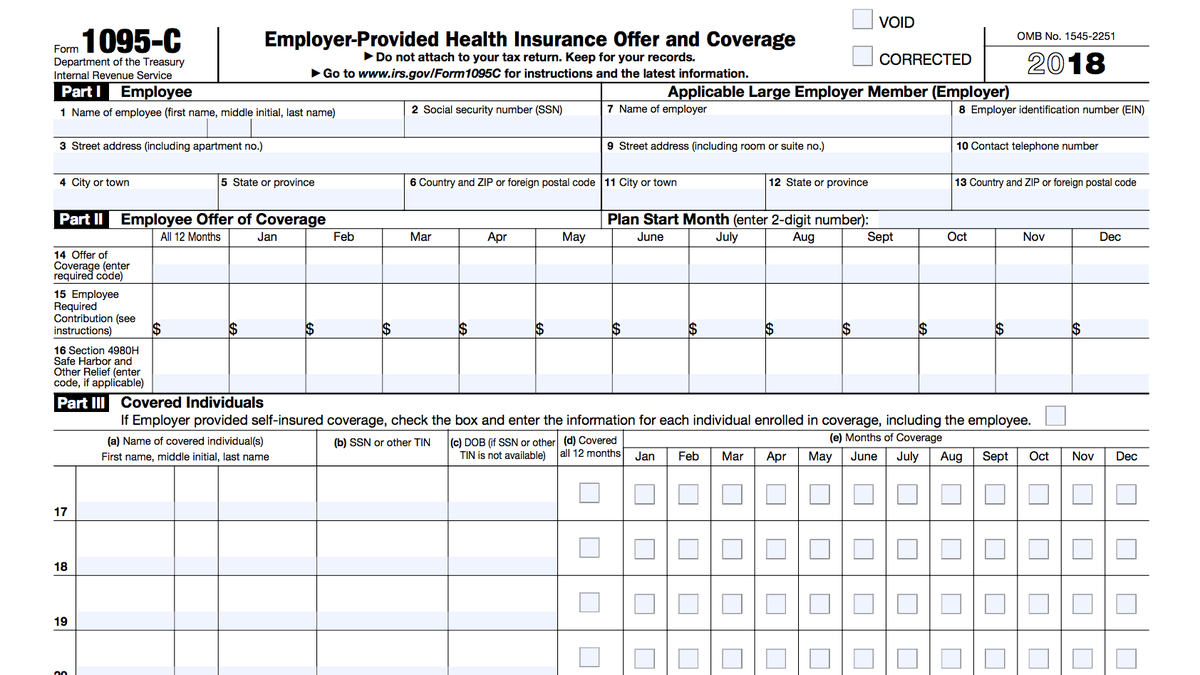

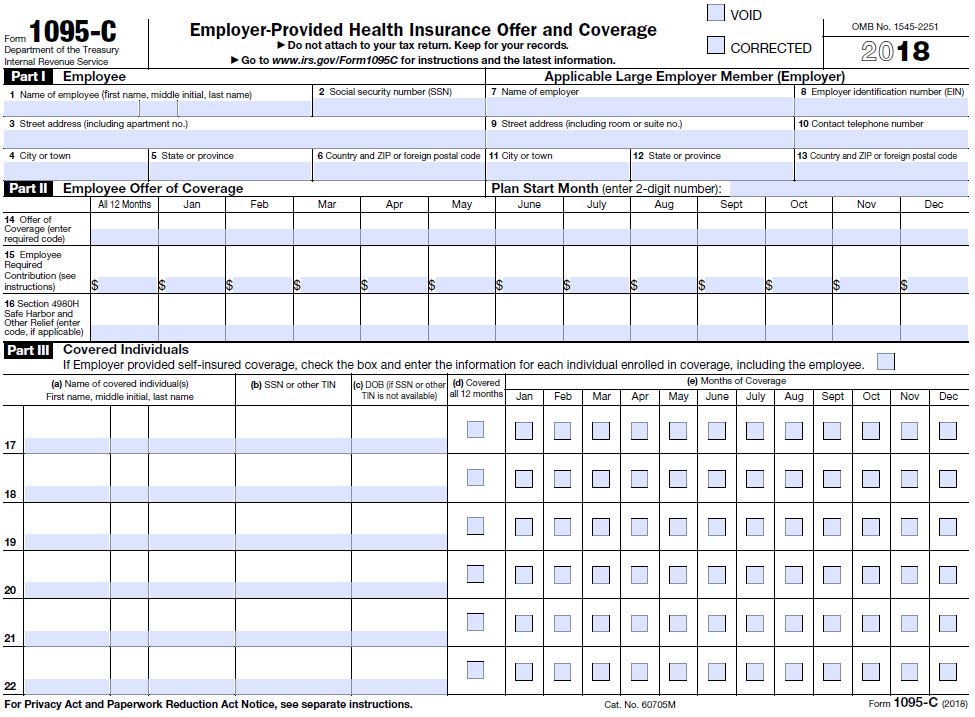

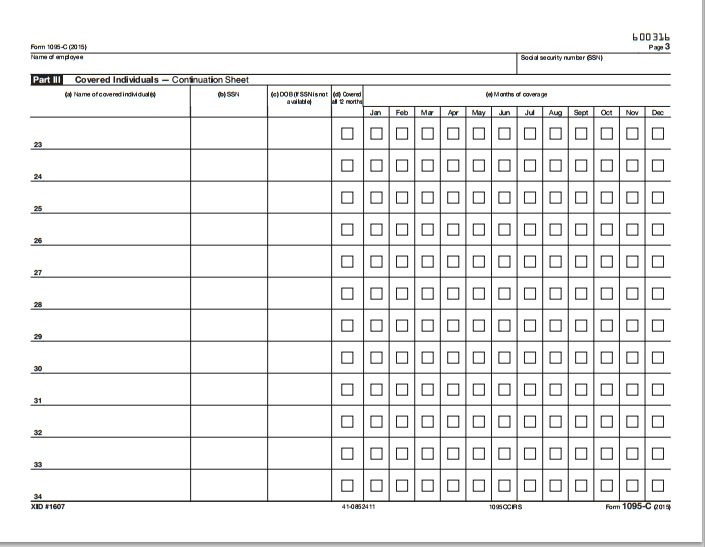

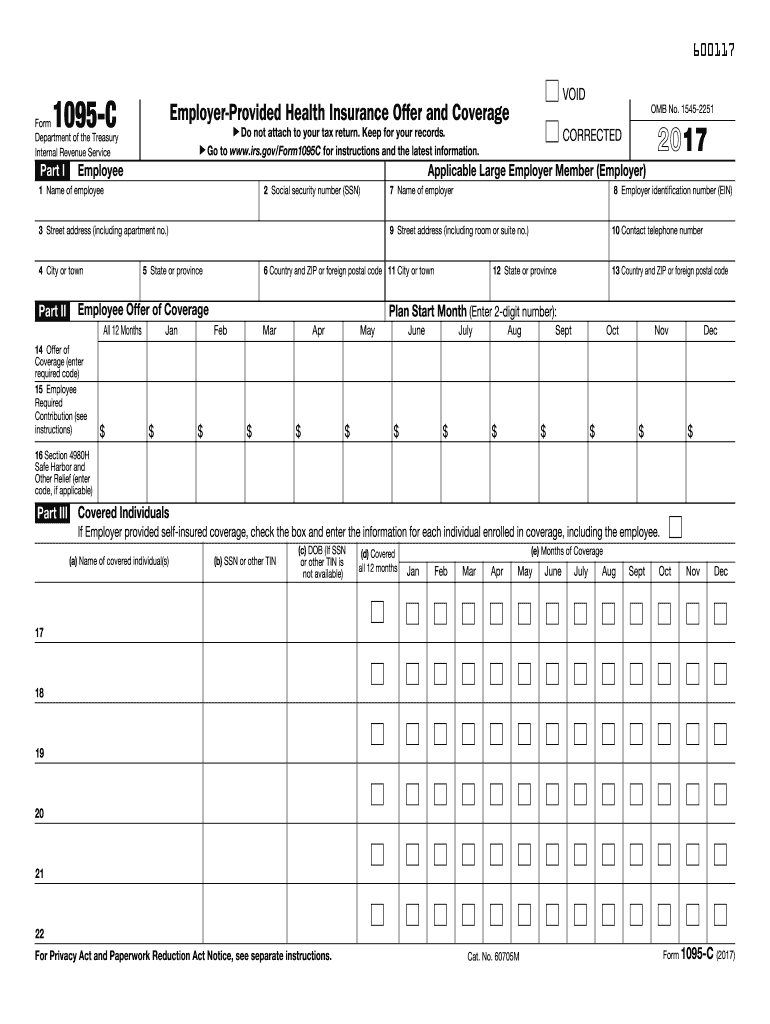

The Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit Think of the form as your "proof of insurance" for the IRSYou are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, PartIRS Form 1095C is filed with the IRS by the applicable large employer (ALE) who offers health coverage and enrollment in health coverage for their employees Employers with 50 or more full time employees are considered ALEs Employers use 1095C Form to report the information required under section 6056 Also it is used to determine whether an ALE Member

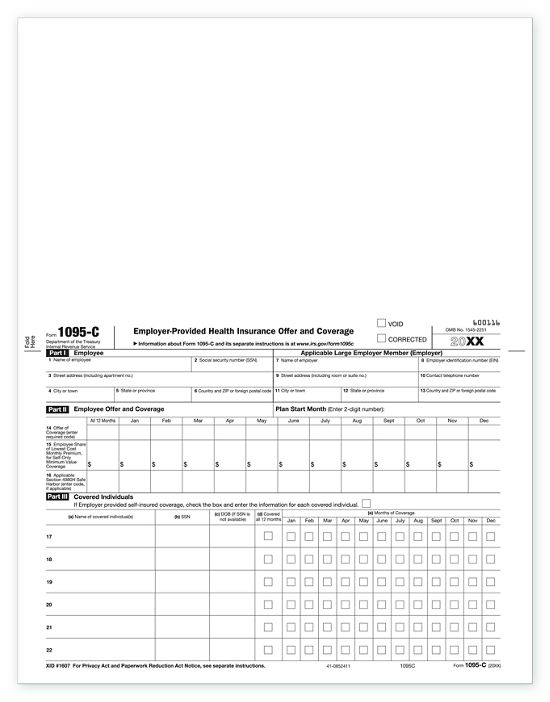

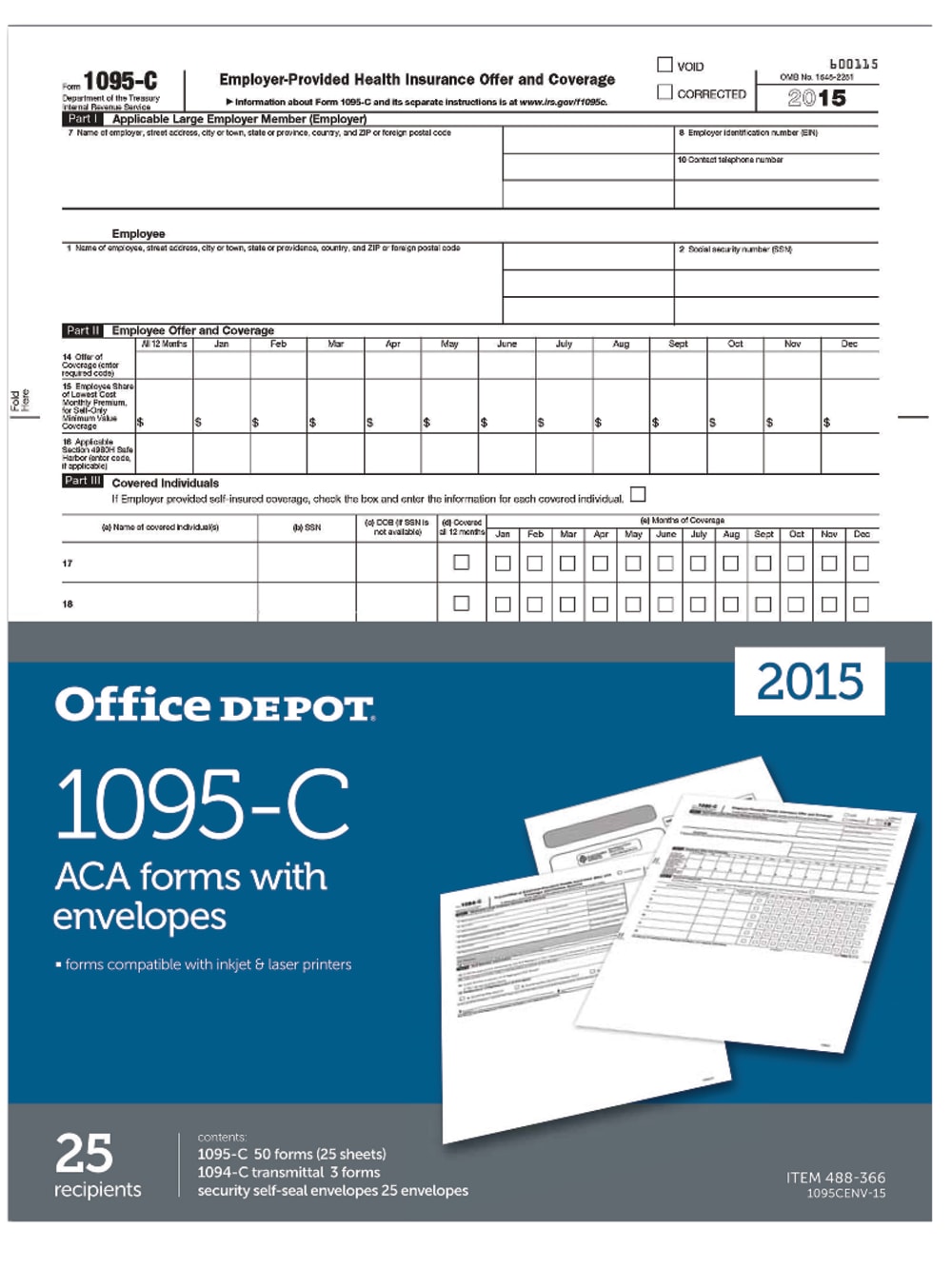

1095 C Employer Provided Health Insurance Offer 500 Sheets

1095 c instructions

1095 c instructions-About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfService2/9/21 · Form 1095C, EmployerProvided Health Insurance Offer and Coverage If you are a fulltime employee (regardless of whether you are enrolled in FEHB, or whether you are eligible for coverage) you will receive an IRS Form 1095C from the Defense Finance and Accounting Service (DFAS) You may also obtain a copy of your form by logging into myPay

What Is The Irs 1095 C Form Miami University

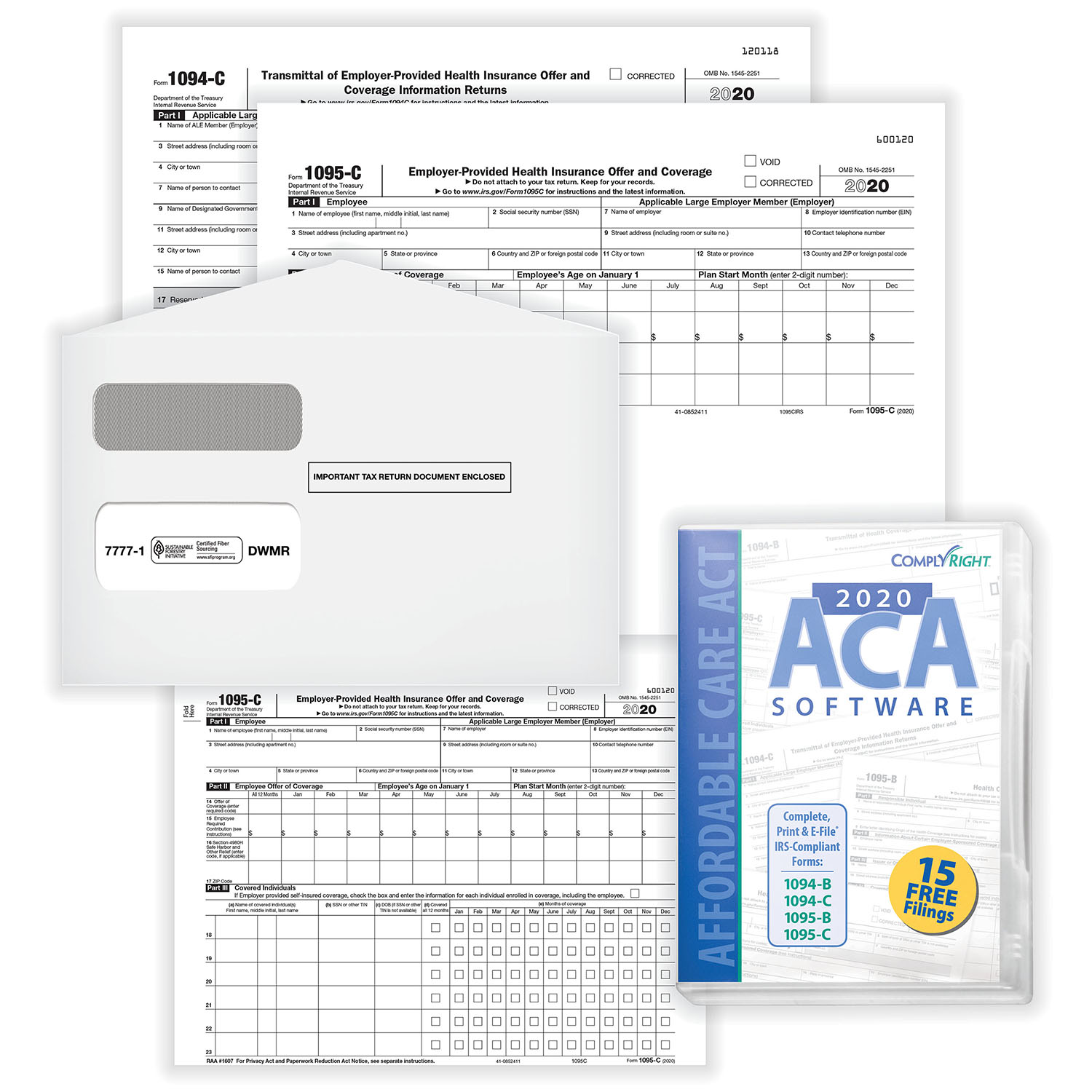

2/6/ · Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by February 28, , if they are filing on paper ALEs filing electronically must file the Form 1094C2/8/19 · IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax season3/10/21 · The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment

IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C and is6/5/19 · No, the 1095C form just proves that you had health coverage It would not affect your refund as long as you answered the Health Insurance questions accurately You don't need your form 1095C to file your tax return TurboTax will ask you questions about your health coverage but your form 1095C isn't needed10// · What is Form 1095C?

Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is used by larger companies with 50 or more fulltime or fulltime equivalent employees This form is used by the employee to report the healthcare coverage offered to them by his or her employerForm 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverageForm 1095C is used to report information about each employee In addition, Forms 1094C and 1095C are used in determining whether an employer owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit

What Is Form 1095 C And Do You Need It To File Your Taxes

Aca 1095 C Basic Concepts

Information on the 1095C Every employee of an ALE who is eligible for insurance coverage should receive a 1095C Eligible employees who decline to participate in their employer's health plan will still receive a 1095C The form identifies The employee and the employer;This pertains to all Krause Group, Kum & Go, Des Moines Menace, Teamwork Ranch, and Solar Transport associates 1095C TAX FORM Part of the ACA legislation requires that Krause Group and all related companies to provide employees that were eligible for health care coverage in with a 1095C tax form The deadline for10/29/ · The ACA Form 1095C, EmployerProvided Health Insurance Offer and Coverage is used by applicable large employers (Employers with 50 employees) to report their employees' health coverage information with the IRS The IRS uses the information on the Form 1095C to determine the following

Aca 1095 C Basic Concepts

17 Tax Year Affordable Care Act Reporting

The IRS uses the information from Form 1095C to administer the Employer Shared Responsibility provision The Form also helps the IRS administer premium tax credits for any employee who qualified and enrolled for coverage at a Health Insurance Marketplace rather6/8/19 · You will want to keep your 1095C with your other tax documents in case the IRS request more verification of your health coverage If you did not receive Form(s) MA 1099HC, check the box to indicate you didn't receive a 1099HC, and enter the name of your insurance company (or administrator) and your subscriber number or member ID6/6/18 · Form 1095C is distributed to eligible employees by employers who have 50 or more fulltime fulltime equivalent employees on average (also known as ALEs) This form provides information regarding the employees such as their name, whether they accepted the coverage, and any dependents covered beneath them

1094 C 1095 C Software 599 1095 C Software

Tax Form Preparation Software 1095 C Software To Create Print And E File Forms 1094 C 1095 C

IRS Form 1095C Filing Instructions for 21 Updated November 05, 800 AM by Admin, ACAwise Every year, ALEs (Employers with 50 employees) must report to the IRS about their offered health coverage information to the employees The information is to be reported through Form 1095C under section 60562/4/21 · An offer of ICHRA coverage will also be reported on Form 1095C for all employees receiving the ICHRA offer, but the details will depend on several variables Keep in mind that the primary purpose of Form 1095C reporting is to determine whether you offered a fulltime employee affordable employersponsored coverage that provides minimum value2/25/21 · ACA reporting for the tax year will be different than years prior, due to the introduction of the new 1095C codes Deadlines are approaching read on to learn more3 minute read ACA reporting for the tax year will be different from years past because of the new Individual Coverage Health Reimbursement Arrangement (HRA) codes

What Is The Irs 1095 C Form Miami University

Irs Form 1095 C Fill Out Printable Pdf Forms Online

The 1095C Form is to report information to the IRS and to employees who have minimum essential coverage under the employer plan and have met the individual shared responsibility requirement for the months that they are covered under the plan You do not need to have a copy of your 1095C in order to file your taxes3/2/21 · Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you by March 2, 21Applicable Large Employers hiring over 50 employees have to use 1095 C Form This document should contain information for employerprovided Health Insurance Offer and Coverage Every fulltime employee has to meet certain health standards For its part, every ALE should pay, record and report insurance expenses to the Internal Revenue Service

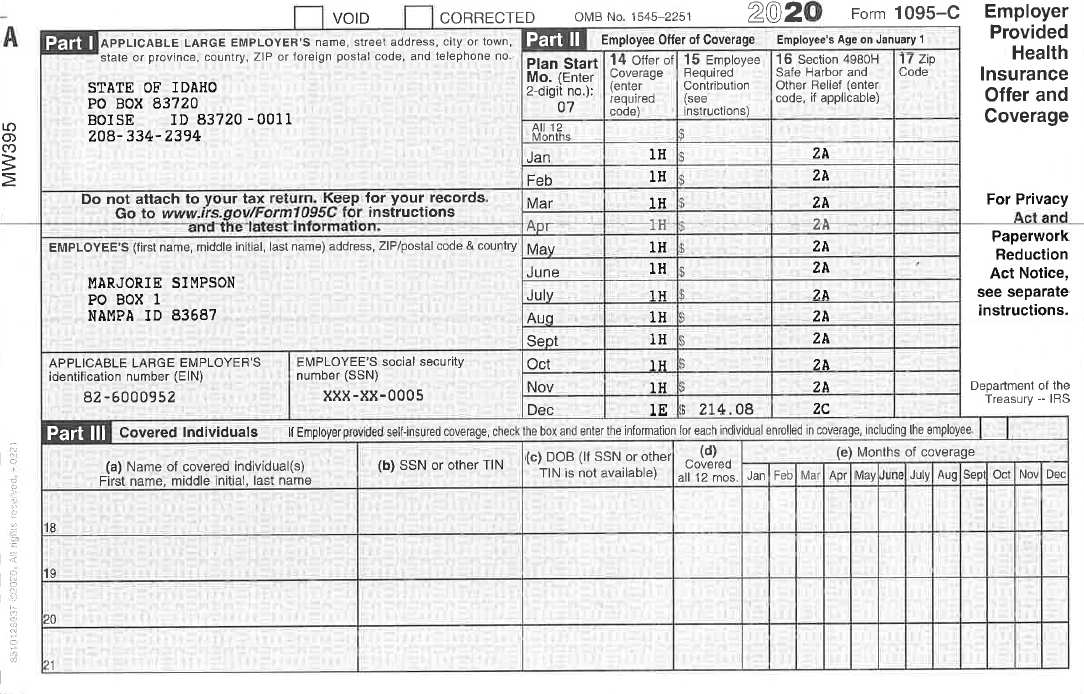

Sample 1095 C Forms Aca Track Support

21 Bulk Laser 1095c Employer Provided Health Insurance Deluxe Com

Form 1095C, EmployerProvided Health Insurance Offer and Coverage provides coverage information for you, your spouse (if you file a joint return), and individuals you claim as dependents had qualifying health coverage (referred to as "minimum essential coverage") for some or all months during the year Note Employers are required to furnish only one Form 1095C for allYour 1095C (EmployerProvided Health Insurance Offer and Coverage) form is now available If you did not elect for electronic delivery, you will be receive your 1095C in the mail If you did elect for electronic delivery (or would like an electronic copy of the form for tax purposes), please use the following steps to retrieve your 1095CLine 16 of IRS Form 1095C lists a code that describes, for each month in the previous year, the kind of coverage that an employee enrolled in, and how the employer meets the employer shared responsibility "Safe Harbor" provisions of Section 4980H Below is a description of the various codes in Code Series 2 2A Employee not employed during the month Enter code 2A if the

How To Accurately Complete Lines 14 16 On Irs Form 1095 C

1095 C Employer Provided Health Insurance Offer Of Coverage

Form 1095C, EmployerProvided Health Insurance Offer and Coverage, is required by companies who meet the qualifications to be considered Applicable Large Employers This includes employers with 50 or more fulltime employees in the preceding calendar year How do I enter information from Form 1095C in TaxAct?Which months during the year the employee was eligible for coverageAll fulltime employees at companies with more than 50 fulltime employees will now receive a Form 1095C to report health care coverage offered by their emp

1095 C Print Mail s

1095 C Form 21 Irs Forms

Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more2/24/ · Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owesYour 1095C Tax Form for 19 You will soon receive your 1095C via US Mail for the 19 tax year containing important information about your health care coverage Employers are required to provide the 1095C to the following employees as part

Benefits 1095 C

Aca Update Form 1095 C Deadline Extended And Other Relief

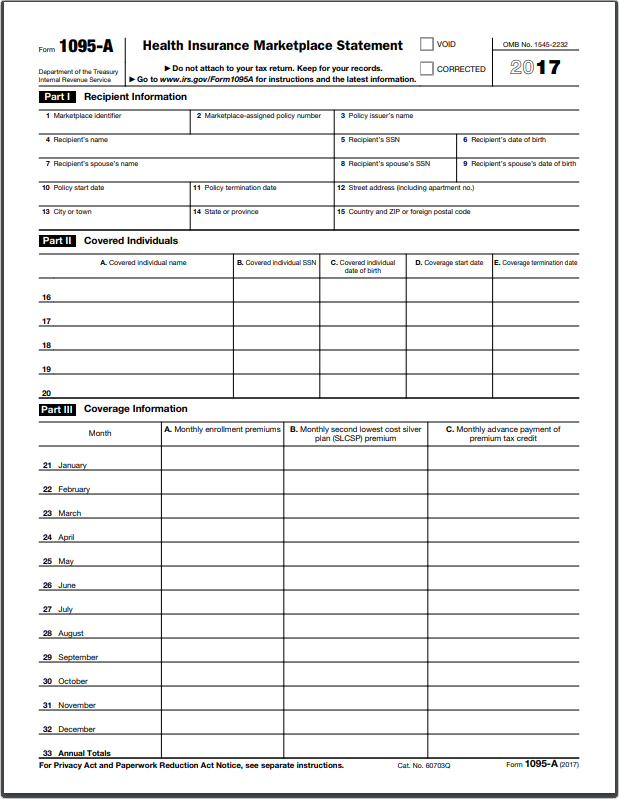

Information on 1095C might be relevant if you had to purchase health insurance via the marketplace (see 1095A below) If you do wish to claim the premium tax credit you, will need Part II of Form 1095C this only applies if you purchased additional healthcare through the marketplace and received a 1095A1//21 · IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated And, employers should use the updated 1095C form to file with the IRS this year1/18/15 · Form 1095C, EmployerProvided Health Insurance Offer and Coverage This form is furnished to those who had employersponsored coverage TIPmore about the reporting requirements here Employers can find out More on 1095B and C Forms

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

Form 1095C is the IRS form employers provide to their employees detailing employerbased health coverage they received during that calendar year Every applicable large employer (ALE) needs to furnish a Form 1095C to each employee with information about their medical benefits for reporting purposesJohn Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning Circle1/26/21 · Form 1095C is a tax form that provides you with information about employerprovided health insurance Only employees who is offered coverage under a policy through an Applicable Large Employer (ALE) receive Forms 1095C, and it is the responsibility of the ALE to generate and furnish the documents to all employees who were fulltime (as

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Hr Updates Theu

3/2/21 · The IRS extended the deadline to provide employees with copies of their 1095C or 1095B health coverage reporting forms from Jan 31The Form 1095C includes information about the health insurance coverage offered to you and, if applicable, your family You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form(s) as a part of your personal tax filingWhat is IRS Form 1095C?

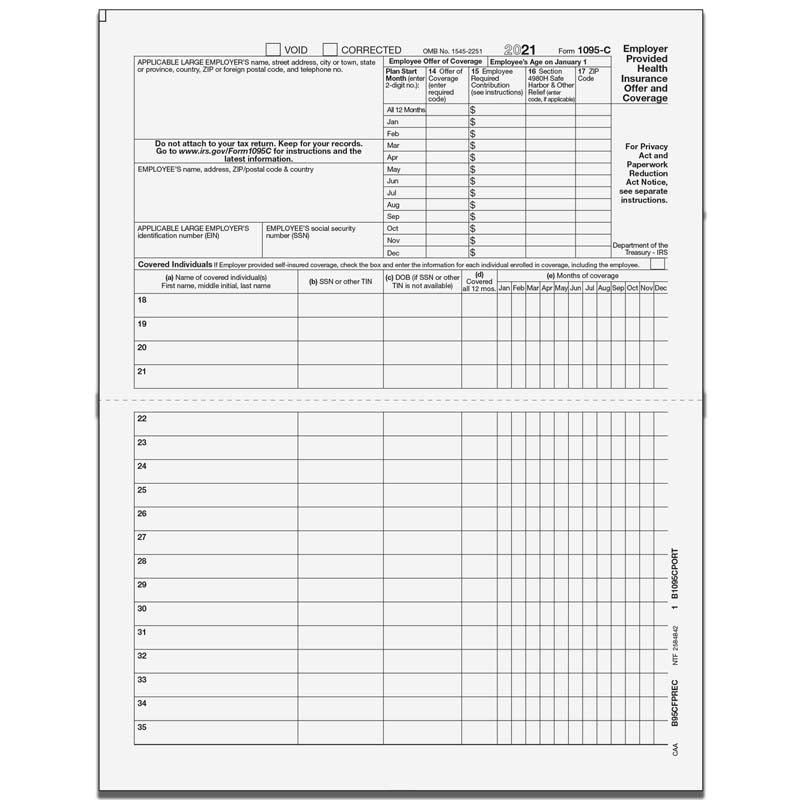

1095 C Preprinted Portrait Version With Instructions On Back

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

The 1095C Form is to report information to the IRS and to employees who have minimum essential coverage under the employer plan and have met the individual shared responsibility requirement for the months that they are covered under the plan You do not need to have a copy of your 1095C in order to file your taxes11/6/ · In such a situation where the business is additionally the protection supplier, it should convey both the structures 1095C and 1095B The main distinction is, they can send the 'B' and 'C' structures on a solitary consolidated structure Due Date In 15, it got compulsory to convey the 1095C structureForm 1095C EmployerProvided Health Insurance Offer and Coverage is a tax form reporting information about an employee's health coverage offered by an Applicable Large Employer (ALE)

Ez1095 Software How To Print Form 1095 C And 1094 C

1095 C Eemployers Solutions Inc

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

Code Series 2 For Form 1095 C Line 16

1095 C Employer Provided Health Insurance Offer And Coverage Form 250 Sheets Pack

Aca And The Vista Hrms Fall Update

Annual Health Care Coverage Statements

What Payroll Information Prints On Form 1095 C To Employees

Affordable Care Act Form 1095 C Form And Software Hrdirect

1095 C Faqs Mass Gov

1095 C Form Official Irs Version Discount Tax Forms

1095 C 18 Public Documents 1099 Pro Wiki

Sample 1095 C Forms Aca Track Support

Form 1095 C Forms Human Resources Vanderbilt University

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

1095 C Fillable Form Fill Out And Sign Printable Pdf Template Signnow

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Code Series 1 For Form 1095 C Line 14

Irs 1095 C Form Pdffiller

Office Depot

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Amazon Com 18 Complyright 1095 C Irs Employer Provided Health Insurance Form Pack Of 100 1095cirsamz Office Products

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Control Tables And Sample Forms

Pressure Seal 1095 C Form Ez Fold Discount Tax Forms

1095 C Aca Transmittal Of Employer Provided Health Coverage Pressure W 2taxforms Com

What Is This Form 1095 Schoppe S Tax Service Inc

What To Do With Tax Form 1095 C

1095 C Images Stock Photos Vectors Shutterstock

1095 C Forms Complyright Software Version Zbp Forms

Amazon Com Egp Irs Approved Laser 1095 C Employer Provided Health Insurance Tax Form Quantity 100 Office Products

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Your 1095 C Tax Form My Com

Obamacare Tax Forms 1095 B And 1095 C 101 Moneytips

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1095 C Continuation Forms For Complyright Software Discount Tax Forms

Form 1095 C Payroll Baylor University

1095 C Form 21 Finance Zrivo

What Is How To Fill It Out Irs Form 1095 C Tax Preparation Services

What Is An Irs Form 1095 C Boomtax

Common Mistakes In Completing Forms 1094 C And 1095 C

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

Aca And The Vista Hrms Fall Update

Changes Coming For 1095 C Form Tango Health Tango Health

Irs Form 1095 C Uva Hr

Irs Form 1095 C Codes Explained Integrity Data

Overview Of 1095c Form

1095 C Continuation Forms Official Irs Version Zbp Forms

Accurate 1095 C Forms A Primer Erp Software Blog

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Accurate 1095 C Forms Reporting A Primer Integrity Data

Form 1095 C Guide For Employees Contact Us

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

Tax Forms 1095 A 1095 B 1095 C Business Benefits Group

Form 1095 C H R Block

Irs Form 1095 C Fauquier County Va

Posts Department Of Human Resources Myumbc

Application Prototyping In Excel 1095 C Beyond Excel

Changes Coming For 1095 C Form Tango Health Tango Health

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

1095 C Employer Provided Health Insurance Offer 500 Sheets

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

1095 C

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Stock Photo Picture And Royalty Free Image Image

1095 C Employer Provided Health Insurance Irs Copy For 5096l Tf5096l

Your 1095 C Obligations Explained

Enroll In Employer Sponsored Health Insurance With Irs Form 1095 C

Non Full Time Employees May Request A Copy Of Form 1095 C Uncsa

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

1095 C Faqs Office Of The Comptroller

trix Irs Forms 1095 C

What S New For Tax Year Aca Reporting Air

What Your Clients Need To Know About Form 1095 C Accountingweb

0 件のコメント:

コメントを投稿